Financial Statement Preparation: Controls, Governance, and Best Practice

Preparing annual financial statements is a critical milestone for any UK business. It’s not just about ticking a compliance box for Companies House – it’s about ensuring the numbers truly reflect your business, instilling confidence in your board and investors, and avoiding nasty surprises at audit time. In the UK, this process comes with its own set of requirements and challenges, from choosing the right accounting framework (FRS 102 or IFRS) to meeting filing deadlines and navigating recent changes in company law. Done right, robust financial statement preparation strengthens governance and trust. Done poorly, it can result in missed deadlines, audit adjustments, and a loss of credibility with stakeholders.

In this post, we’ll explore the UK requirements for submitting financial statements (with a focus on FRS 102 and UK-adopted IFRS), why early preparation is so important, how to prepare pro-forma accounts to anticipate changes in law and standards, and what can go wrong if you don’t. We’ll look at it from a CFO/financial controller perspective – how solid controls and good practices provide confidence to the board – and highlight real examples of failures (and successes). Finally, we’ll outline best practices and explain how expert support can help ensure a smooth year-end process (so you can focus on running the business). Let’s dive in.

UK Financial Statement Requirements and Frameworks

All UK companies must prepare annual accounts and file them with Companies House by strict deadlines. For most private companies, the filing deadline is nine months after the financial year-end (for example, a 31 December 2024 year-end must be filed by 30 September 2025). Public companies have an even tighter deadline of six months. Missing those deadlines triggers automatic penalties – and they escalate quickly. In 2023/24, Companies House issued a record £34.4 million in fines to companies that were seriously late in filing accounts for two consecutive years. For a private company, the late filing penalty starts at £150 (if up to one month late) and increases to £1,500 if more than 6 months late. And remember, late filing isn’t just a financial hit; it’s actually a criminal offence for directors, with potential personal repercussions and even company dissolution if accounts are extremely overdue. In short, timely financial reporting is a legal obligation that UK directors must take seriously.

Accounting standards – FRS 102 vs. IFRS: Along with deadlines, UK businesses need to select the appropriate accounting framework for their financial statements. Broadly, the choice is between UK GAAP (generally FRS 102 for medium and large entities, with FRS 105 for micros and FRS 101 for certain subsidiaries) and International Financial Reporting Standards (IFRS, as adopted in the UK). Regulation dictates some of this choice. If your company is listed on a UK regulated market or AIM, you must use UK-adopted IFRS for your consolidated accountsifrs.orgifrs.org. Other companies have flexibility – many private companies use FRS 102 (the Financial Reporting Standard applicable in the UK and Republic of Ireland), though they may opt for IFRS if, for example, they aspire to list or want consistency with an IFRS-reporting parent group. Each framework has its implications:

-

FRS 102 (UK GAAP): Designed for UK entities not using IFRS, FRS 102 is a single standard that covers recognition and measurement across all typical areas (with reduced disclosures for small entities). It’s broadly based on older IFRS principles but is often simpler in practice. For instance, under current FRS 102, leases are split into finance vs operating; operating leases are kept off the balance sheet with rent expensed straight-line Revenue recognition under FRS 102 follows a “risks and rewards” approach – basically recognize revenue when it’s probable and can be measured reliably – which can be more straightforward than IFRS in many cases. FRS 102 also permits certain accounting policy choices (e.g. one can choose to expense development costs even if they meet criteria to capitalize). These simplifications can make FRS 102 accounts shorter and quicker to prepare.

-

UK-adopted IFRS: IFRS, on the other hand, is more globally standardized and can be more complex. IFRS standards like IFRS 16 on leases require putting almost all leases on the balance sheet (with a right-of-use asset and lease liability), involving present value calculations and new depreciation and interest entries. IFRS 15’s five-step model for revenue means companies must identify performance obligations and recognize revenue when control passes, which may differ from the timing under FRS 102. IFRS also demands more granular disclosures. One noticeable difference is the sheer volume of detail: full IFRS financial statements require significantly more disclosure than FRS 102, often resulting in much longer annual reports. All those extra notes and accounting policy explanations mean more work to prepare and review – and more information going on the public record at Companies House, which some privately-held companies might prefer to avoid. In short, IFRS can offer greater transparency and comparability (useful if you’re competing for capital or tenders with larger IFRS-reporting companies), but this comes at the cost of complexity and time. As one accounting firm noted, the compliance cost and time will increase when preparing statements under IFRS versus FRS 102. CFOs should weigh these factors when choosing a framework. (For many smaller companies, FRS 102 with its reduced disclosure options is sufficient; for a high-growth tech company eyeing an IPO, moving to IFRS could make sense to align with investor expectations.)

Upcoming changes: It’s worth noting that UK GAAP itself is evolving. The Financial Reporting Council (FRC) has approved significant amendments to FRS 102 (effective for 2025/26 year-ends, with early adoption allowed) to more closely align with newer IFRS in key areas. Two headline changes are the introduction of an IFRS 15-style revenue recognition model and an IFRS 16-style lease accounting model in FRS 102. This means many businesses that currently enjoy simple off-balance sheet treatment for operating leases under FRS 102 will, in the near future, have to bring those leases onto the balance sheet, and revenue might be recognized differently under a 5-step approach. These changes are coming down the line, so preparing for them in advance (more on this later) is wise. At the same time, the UK government is increasing transparency requirements in company filings. Under the recently passed Economic Crime and Corporate Transparency Act 2023, small companies will no longer be able to file abridged accounts – soon they’ll have to file a full profit and loss account and directors’ report, just like large companies. And by April 2027, Companies House will require all accounts to be filed digitally using software (no more paper filings). In other words, over the next couple of years, every company – even the small ones – will be held to higher reporting standards and greater public disclosure. This makes it even more important to get your financial statements right: more eyes will be on them, and there will be fewer shortcuts available to reduce the reporting burden.

The Importance of Preparing Early (Don’t Wait Until Year-End!)

Given these requirements and upcoming changes, one of the best pieces of advice is don’t leave financial statement preparation to the last minute. Seasoned CFOs know that a well-planned year-end can make the difference between a smooth close and a mad scramble (or missed deadlines). Why is early preparation so critical?

-

Avoiding last-minute surprises: By starting the process before the year-end (or well before the filing deadline), you give yourself time to identify and resolve issues. For example, if there’s a complex transaction or a new accounting standard applicable, it’s far better to tackle its accounting in advance. Consider the upcoming FRS 102 changes aligning with IFRS 15 and 16 – companies will need to collect and analyse data on all their revenue contracts and leases ahead of implementation. If you leave that exercise until after the year-end, you might find you don’t have the necessary data or systems in place, leading to delays. The head of financial reporting at RSM UK noted that now that the FRS 102 amendments are published, companies should “start to assess the impact of the new standards on their financial statements, systems and processes” and plan communications with stakeholders about the changes. In practice, this means doing dry-runs or pro-forma financial statements under the new rules to see how things will look. Early dry-runs can reveal, for instance, that bringing leases on-balance sheet will hit your debt ratios or EBITDA – something you’d want to know before it becomes official, so you can manage investor expectations and bank covenants.

-

Meeting reporting deadlines with ease: A big part of preparation is simply project management. If you know you have a nine-month window to file, don’t use eight and a half months just getting the accounts ready. Aim to close the books and draft the financials as early as feasible. Many companies set an internal deadline to have draft financial statements and initial management/audit committee review done within, say, 2-3 months after year-end (depending on complexity). That way, you leave plenty of buffer for the audit and any unforeseen adjustments. Starting early also helps coordinate with the board’s schedule – e.g. ensuring the board meeting to approve the accounts isn’t too close to the filing deadline. Remember, auditors also have busy seasons and booking their time early is important. Nothing is worse than needing an audit sign-off on the last day only to find the audit partner is tied up with another client because your audit slipped. By preparing early, you can agree on an audit timetable well in advance and lock it in. (In fact, a good first step post year-end is to meet with your auditors to set expectations and a timeline – a UK audit readiness checklist recommends doing this to reduce stress on the finance team.)

-

Pro-forma statements and rolling closes: Best-in-class finance teams don’t view financial statement prep as a one-time annual event; they treat it as a year-round exercise. Many will maintain rolling financial statements – essentially updating the notes and schedules quarterly so that the year-end statements are an update rather than a creation from scratch. For example, if you know the Companies Act (CA 2006) or accounting standards have introduced new disclosure requirements this year (perhaps new disclosures on supplier payment times or uncertain tax positions), you can incorporate a draft of those disclosures early. That way you’re not frantically writing new notes to the accounts in the week before filing. Similarly, preparing a month 12 “pre-close” set of accounts (before all audit adjustments) can flag any unusual balances that need attention while you still have time. By the final quarter of the year, you might even prepare a pro-forma set of full financial statements for internal review – essentially a dress rehearsal – to ensure everything ties out and to let the board see the expected results early. This can be invaluable if the board wants certain issues addressed or more information in the reports; you have time to accommodate that feedback. It also gives management a chance to consider the narrative (e.g. in the strategic report or management commentary) that will accompany the numbers.

-

Handling complex areas ahead of crunch time: Certain accounting areas are notorious for causing last-minute headaches – think impairment reviews, valuations, pensions, deferred tax calculations, revenue cut-off, etc. Tackling these as early as possible is a lifesaver. For instance, if a business has goodwill or other intangibles that might be impaired, doing the impairment analysis before year-end (using forecast data) means you won’t be doing Excel gymnastics under time pressure later. If the analysis indicates a potential write-down, management can strategize how to communicate that to stakeholders (and maybe even take action to avoid impairment). Another example: if you have to adopt a new standard like IFRS 16 (leases) or IFRS 17 (insurance contracts) for the first time, the implementation effort can be huge – many companies begin their projects a year or two in advance. Early preparation gives you breathing room to get things right. As one CFO quipped, “No one likes financial reporting surprises – not the board, not the auditors, and not me as CFO.” Starting early is the best way to eliminate the surprises.

-

Regulatory and group reporting alignment: For certain industries, the audited financial statements feed into other reporting. For example, insurance companies rely on audited figures for their Solvency II regulatory returns. The Solvency II annual filings typically must be submitted only a few weeks after the audit sign-off (for instance, solo insurers have about 14 weeks after year-end to submit annual Quantitative Reporting Templates). If your statutory accounts are delayed or full of errors, it can wreak havoc on meeting those regulatory deadlines – or worse, cause inconsistencies that draw regulator scrutiny. Likewise, if you’re a subsidiary in a larger group, your parent company likely sets a deadline to submit your results for group consolidation (often much sooner than your own filing deadline). Preparing well in advance ensures you can meet those timelines too, keeping the parent CFO happy. No one wants to be the subsidiary holding up the group’s annual report!

In short, early and thorough preparation is an investment. It may require some discipline (and yes, hard work) ahead of year-end, but it pays off by reducing errors, stress, and late nights later. You’ll thank yourself when the audit is wrapped up smoothly and the board is nodding with approval instead of grilling you on why things are behind schedule.

Governance, Controls, and Management Confidence

Beyond compliance and avoiding fines, robust financial statement preparation is foundational to good corporate governance. The board of directors, after all, relies on the financial statements to fulfill its duties. In the UK, the Corporate Governance Code explicitly states that the board is responsible for ensuring the integrity of financial statements and that the annual report is fair, balanced, and understandable. A CFO who consistently delivers accurate, well-prepared accounts is helping the board meet these obligations and demonstrating the finance team’s integrity and competence.

From a management perspective, having strong controls and processes around financial reporting provides a huge confidence boost – both internally and externally. Let’s break down a few angles:

-

Trust with the Board and Shareholders: The CFO is often seen as the guardian of financial integrity. When you present financial results to the board, you want to do so with confidence that the numbers are right and that you can explain them clearly. Any hesitation or errors can plant seeds of doubt. Imagine a scenario where, during the board meeting, last-minute adjustments are still being made or the auditors have identified significant misstatements post year-end – this could be quite damaging to management’s credibility. Conversely, delivering draft financials early to the audit committee, with all major issues resolved and a clear story of the year’s performance, sends a strong message that “we have a handle on the business.” According to a CFO playbook on board reporting, transparency and accuracy in financial reporting are paramount – CFOs must ensure information is accurate, reliable, and transparent, and be able to articulate where the numbers come fromthe-cfo.io. By rigorously preparing and double-checking the financial statements, you enable effective governance. The board can trust the data and focus on strategic questions, rather than nitpicking the figures. Over time, consistently clean audits and timely accounts build a reputation for management as capable and trustworthy – a priceless asset.

-

Internal control culture: A well-prepared set of accounts is usually the product of a company with good internal controls over financial reporting. Things like regular reconciliations, proper documentation of judgments, and oversight by qualified professionals throughout the year all feed into the final output. If those controls are weak, it shows up in the year-end crunch – for example, unexplained balances, mysterious write-offs, or an inability to substantiate numbers to auditors. On the other hand, strong controls mean the year-end financial statements are more of a formality because the books have been “kept clean” all year. Regulators and investors are increasingly interested in internal controls. (The UK is even contemplating a “UK SOX” regime that would require directors to attest to internal control effectivenessgov.uk.) Even if not yet mandatory, it’s good practice for boards to ask management about control weaknesses and how they’re being addressed. In fact, the FRC’s guidance suggests boards should consider any control failings or “near misses” when evaluating financial reporting integrityfrc.org.uk. By investing in robust preparation processes, CFOs can report to the board that controls have operated and any issues were fixed long before the year-end. This instills confidence that the figures can be relied upon. It also reduces the risk of fraud or error going undetected – a major governance concern.

-

Smoother audits and fewer adjustments: Good preparation and good controls lead to clean audits – meaning minimal audit adjustments and no unpleasant surprises. From a governance standpoint, an audit with lots of findings or corrections is a red flag. It implies management might not have adequate expertise or oversight on the financials. Auditors in the UK will report control problems or significant errors to the Audit Committee through a management letter. If that letter is several pages of issues, you can bet the Audit Committee (and possibly regulators like the FRC) will have tough questions for the CFO. Repeated misstatements could even lead to restating prior results, which is bad news for investor confidence. In contrast, a well-controlled close process might yield only a few minor audit adjustments (or none at all). That tells the Audit Committee that the finance team is doing its job well. It can also save the company money – fewer issues mean less audit work and potentially lower audit fees (or at least no extra overruns). While not every reader may be familiar with loan covenants, it’s worth noting here: many loan agreements include a covenant that audited financial statements must be provided by a certain date. If management drops the ball and statements are delayed or materially wrong, it can breach debt covenants. In fact, failing to submit audited accounts on time to a lender is a textbook example of a reporting covenant breach. That can trigger defaults or penalties, which the board would view as a serious lapse. Strong reporting processes help avoid such breaches and the governance nightmare they would create.

-

Reputation and external perceptions: Financial reporting is one of the most public reflections of a company’s governance quality. Analysts, investors, and credit rating agencies pay attention to timeliness and accuracy. For instance, if a public company delays its earnings release or audit sign-off, markets tend to react negatively – it signals potential problems. Even in the private sphere, your reputation with creditors and partners can suffer if you’re known to file late or correct your accounts frequently. On the flip side, companies known for high-quality reporting tend to enjoy better relationships with stakeholders. Lenders trust their numbers, investors have confidence in the management team, and regulators possibly scrutinize them a bit less. A case in point: when P&O Ferries (a well-known ferry operator) repeatedly delayed its financial statements, it not only attracted regulatory attention but also strained its relationship with its auditor. KPMG resigned as P&O’s auditor after nearly two decades, following P&O’s failure to file its 2023 accounts on time (the 2022 accounts were only filed in December, very late). Such an auditor resignation sends a loud alarm to the market and the board that the company’s financial governance was below par. No CFO or board wants to be in that situation. It underscores how poor preparation (and the resulting delays/issues) can escalate into full-blown governance crises.

In summary, robust financial statement preparation isn’t just an operational task – it’s a strategic and governance priority. It reinforces the integrity of the company, helps the board fulfill its responsibilities, and builds confidence among all stakeholders that management knows what it’s doing. As a CFO or CEO, making this process solid is akin to laying a strong foundation for your financial house.

The Cost of Poor Preparation: Pitfalls and Consequences

We’ve hinted at many of these already, but let’s crystallize what can go wrong when financial statement preparation is handled poorly (or procrastinated) – and conversely, what you stand to gain by doing it right. Here’s a quick comparison:

| Pitfalls of Poor Preparation | Benefits of Robust Preparation |

|---|---|

| Missed deadlines leading to fines and last-minute scrambles to file accounts. This can snowball into higher penalties for repeat offenses and even legal action by regulators. | On-time (or early) filings with comfortable buffer before deadlines, avoiding penalties and stress. Management and directors stay in good standing with regulators. |

| Frequent errors and audit adjustments because the books weren’t clean or reviewed. Rushed, last-minute work increases the risk of material misstatements, which could force restatements or qualified audit opinions. | Accurate financials with minimal auditor corrections, reflecting strong internal controls. Little to no need for restatements or late changes, giving stakeholders confidence in the numbers’ reliability. |

| Board and investors lose confidence due to surprises, such as an eleventh-hour write-off or a significant audit finding. In worst cases, poor financial reporting erodes trust to the point of impacting valuations or the willingness of investors to provide capital. | Board and stakeholders trust the financial reporting, reinforcing management’s credibility. No unpleasant surprises means discussions can focus on performance and strategy, not on explaining mistakes or delays. A track record of clean reporting can improve investor relations and ease future fundraising. |

| Strained auditor relationships; potential for increased audit fees or even auditor resignation. If auditors encounter disorganization or lack of cooperation, they may bill more for the extra work, or in extreme cases step away (as seen with P&O Ferries’ auditor resigning amid delays). A poor prep also raises the risk of a harsh management letter pointing out control failings. | Productive, cooperative audit process, often finishing on schedule (or early) with no major issues. This can help contain audit fees (no surprise overruns) and fosters a positive long-term relationship with your auditors. A clean bill of health from auditors (no significant control issues noted) further enhances your company’s standing. |

| Covenant breaches and knock-on effects on other reporting. For instance, delivering audited accounts late might breach loan covenants that require timely financial reporting – putting you in technical default. Delays in accounts can also cascade into delays in regulatory reports (e.g. Solvency II for insurers) or group consolidations, causing wider business issues. | Compliance with all related obligations, from loan covenants to regulatory filings. By getting your statutory accounts done right and on time, you ensure that lenders, regulators, and parent companies receive the information they need. This safeguards your access to credit and avoids regulatory scrutiny or default scares. |

As the table above shows, the differences between a haphazard approach and a well-managed process are stark. Poor preparation can cost a company money, reputation, and even threaten its existence (in extreme cases of governance failure or financing covenant breaches). In contrast, robust preparation creates a virtuous cycle of timely compliance, accurate reporting, and stakeholder trust.

A real-world example to drive this home: consider a company that fails to plan and ends up filing accounts late. Aside from fines, suppose that company also had bank loans – by filing late, they breached a covenant to provide audited accounts within a certain timeframe. The banks could then impose penalties or demand immediate repayment due to the default. Now add an auditor who’s frustrated with the chaos and perhaps flags a material weakness in controls. The next thing you know, the board is launching an internal investigation or bringing in advisors to fix the finance function. It’s a spiral no one wants to experience. Sadly, these scenarios do happen (often quietly). The good news is they are entirely preventable with the right approach to financial statement preparation.

So, what does that right approach look like? Let’s outline some best practices that CFOs and finance teams can implement to ensure success.

Best Practices for a Robust Financial Statement Preparation Process

Achieving a smooth year-end and high-quality financial statements requires a combination of people, process, and technology. Here are some tried-and-true best practices that can transform your financial statement prep from a fire-fighting exercise into a well-oiled routine:

1. Plan Ahead with a Detailed Timeline: Treat the year-end close as a project with a clear timeline and milestones. Create a backwards calendar from the filing deadline: for example, if accounts must be filed by Sept 30, set an internal deadline of Aug 31 for having the final draft ready for board approval, and maybe July for completion of audit fieldwork. Schedule interim check-ins to ensure you’re on track. It helps to break the work into phases – e.g. month-end closing of ledgers by mid-January, first full draft of financial statements by end of February, audit committee review in March, etc. Agree these dates with your auditors early. Auditors appreciate certainty; by booking their fieldwork slot well in advance and communicating when you’ll have deliverables ready, you reduce the risk of audit delays. Essentially, project management discipline is your friend. Many accounting teams use close checklists or even software tools to monitor progress on all the tasks (accruals, reconciliations, drafting notes, etc.). By having a clear plan, your team knows what needs to be done each week, rather than everything piling up at the end.

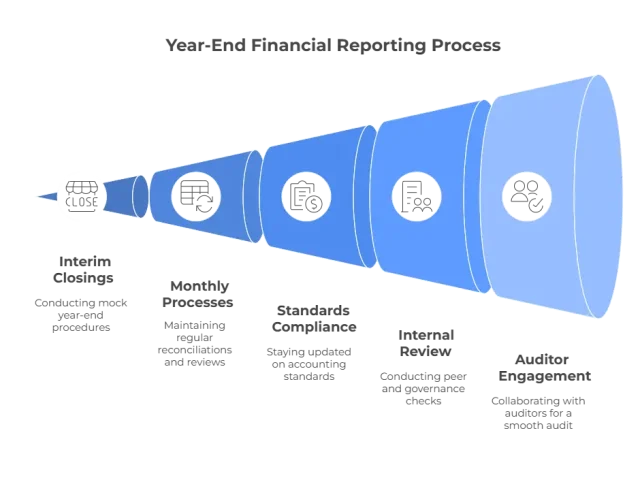

2. Leverage Interim Closings and Pro-Forma Statements: Don’t wait until year-end to assemble your financial statements for the first time. If you produce quarterly or monthly management accounts, consider expanding one of those later in the year into a mock year-end close. For instance, some companies do a “soft close” at Q3 where they run through many year-end procedures (stock counts, impairment reviews, etc.) in advance. This can surface any accounting issues early. Also, if you anticipate transactions or adjustments at year-end (like a disposal of a business, a big fair value adjustment, or adoption of a new accounting standard), try to model those in a pro-forma set of accounts ahead of time. As mentioned earlier, with FRS 102 changing to include IFRS-like revenue and lease rules, a savvy finance team will simulate the impact on their financial statements well before the mandatory adoption date. That might involve, for example, gathering all lease agreements and calculating what the balance sheet gross-up would be under the new rules, so there are no surprises. By doing this kind of preparation, you also identify any gaps – maybe you discover you need better data from your leasing system, or that your revenue contracts team needs to capture performance obligations in a new way. It’s much easier to fix those gaps with time to spare than under the gun during the year-end close.

3. Maintain Rigor in Monthly Processes: Financial statement prep starts on day 1 of the fiscal year, not day 360. By keeping up with monthly/quarterly reconciliations and reviews, you ensure there’s no mountain of cleanup at year-end. Every balance sheet account should be reconciled regularly (bank recs, customer and supplier ledgers, intercompany balances, etc.). If something doesn’t tie out, investigate it promptly rather than carrying an unexplained difference into year-end. Ensure revenue and expenses are properly cut off each month. Essentially, run your finance team on a no surprises basis. Many successful companies operate a “fast close” each month – for example, closing books within 5 working days – which means at year-end, the process is just an extended version of the norm, not a shock to the system. Having strong internal controls throughout the year is key. Controls might include things like checklists for review of critical estimates, segregation of duties so no one person can make stealth adjustments, and analytical review comparing actuals to forecasts to spot anomalies. These internal controls “support and enforce the accuracy, reliability, and integrity” of your financial statements. When auditors see a solid routine and control culture, they often can place more reliance on your numbers (meaning fewer detailed tests on their part) – speeding up the audit and building their trust in management. To understand the importance of balance sheet reconciliations, review our Complete Guide to Balance Sheet Reconciliations.

4. Stay Up-to-Date on Standards and Regulations: Accounting standards and disclosure requirements do change, and ignorance is not bliss in this case. Make it a habit to review any updates from the FRC, IASB, or Companies House that could affect your financial reporting. For example, if there’s a new requirement to disclose climate-related risks or a change in the Companies Act affecting what you must file, plan for it early. Subscribe to technical updates or use advisors who can brief you. If your company is using IFRS, keep an eye on new standards (like the recent IFRS 16, IFRS 15 implementations, or industry-specific ones like IFRS 17 for insurance). Under UK GAAP, watch for FRC’s FRED (Financial Reporting Exposure Drafts) consultations – that’s how the recent major changes to FRS 102 were telegraphed. In fact, companies that responded early to FRED 82 (the proposal to amend FRS 102) had a head start in understanding what was coming. The takeaway is: technical competence is a pillar of good financial reporting. Whether in-house or via external accounting firms, ensure you have access to expertise for complicated areas. This prevents errors and also saves time – it’s much quicker (and safer) to get an accounting treatment right the first time than to have auditors find it wrong and require a correction.

5. Robust Internal Review and Governance Checks: Before the numbers ever leave your building (figuratively speaking), they should undergo thorough review. This includes peer reviews within the finance team (e.g. someone re-checking key calculations or reconciliations), as well as a higher-level review by the CFO or Financial Controller for consistency and sense. Many companies use disclosure checklists to make sure all required notes are included – these can be obtained from audit firms or professional bodies. It’s also wise to have a pre-audit meeting with the Audit Committee (if you have one) or at least with some board members, to walk them through the draft results and any significant judgments. Their questions might highlight areas where further clarification is needed. Also involve other departments where relevant – for instance, legal counsel might need to review contingent liability disclosures, or HR might need to validate pension assumptions, etc. A cross-functional review can catch issues that a siloed approach might miss. The goal is that by the time the auditors see the accounts, management has already scrubbed them thoroughly. One pro tip is to prepare a “board pack” or a set of analytical review documents for the board/audit committee, explaining the year-on-year movements, key ratios, etc. Not only does this help the board digest the information, it doubles as your own sense-check that everything in the financials has an explanation.

6. Engage with Auditors as Partners: The external auditors are not adversaries – ideally, they’re partners in achieving a reliable financial report. Engage with them early and often. Before the audit starts, agree on a list of schedules and working papers they’ll need (auditors typically provide a PBC – “Prepared by Client” – list). Assign responsibilities within your team to prepare these items and have them ready on day 1 of the audit. If you anticipate tricky areas of audit focus (say, revenue recognition on a complex contract, or a legal dispute outcome), talk to the auditors about it beforehand, maybe even during the year. You can seek their preliminary views or at least alert them to what management’s position will be. This pre-empts protracted debates later. Also, establish a clear protocol for the audit: for example, daily check-ins during fieldwork to address any requests or issues promptly. By fostering a cooperative relationship, you reduce friction. Auditors will feel more comfortable asking questions, and you’ll resolve them faster. A smooth audit is not only good for your nerves – it means the audited numbers are finalized in a timely manner, which again keeps you on track for those filing deadlines. And as noted, fewer audit issues can sometimes keep a lid on audit fees (since many firms price based on time spent – less firefighting equals fewer billable hours).

7. Utilize Technology and Automation: If you’re still wrangling with giant spreadsheets and manual processes, consider investing in software that can streamline financial reporting. There are now close management tools, consolidation systems, and disclosure management software that can automate many steps, reduce errors, and even produce iXBRL-tagged accounts ready for digital filing. With the UK moving to software-only filing by 2027, it’s a good time to evaluate whether your current systems are up to scratch. For instance, an integrated ERP system can ensure all transactions are recorded consistently; a consolidation tool can handle intercompany eliminations and foreign currency translation at the push of a button; a disclosure checklist software can auto-flag missing note disclosures. Even something as simple as using Excel formulas to link your financial statements and notes (so that if an underlying number updates, all references update) can save a ton of time and prevent inconsistency. The right tech can also free your finance team from drudgery so they can focus on analysis and ensuring the story behind the numbers is coherent.

8. Prepare for the Worst (Contingency Planning): Hope for the best, but have a backup plan. What if a key team member falls ill during year-end, or your accounting software experiences an outage at a critical moment? Identify the biggest risks to your reporting timeline and have mitigations ready. This could mean cross-training staff so that more than one person knows how to perform a critical task, or scheduling around holidays/vacations to ensure adequate coverage. If you have overseas subsidiaries or remote teams contributing, make sure time zone differences and communication lines are sorted out. Also, if you feel you might miss the deadline despite best efforts (due to a major event outside your control), remember that Companies House allows you to apply for an extension before the deadline, if you have a valid reason (for example, your accounts preparation was delayed by an unforeseeable event)gov.uk. It’s better to be proactive in such a scenario than to simply file late without warning. But generally, with proper planning as outlined above, extensions can be avoided.

By implementing these best practices, companies can significantly de-risk their financial statement process. It transforms what can be a nerve-wracking annual chore into a routine, well-managed business process. Your finance team will thank you, your auditors will respect you, and your board will have peace of mind.

Conclusion: Investing in Integrity (and How We Can Help)

Financial statement preparation might not be the flashiest part of running a company, but it is absolutely foundational. It’s about integrity, trust, and control. A robust preparation process ensures that you, as a CFO or business owner, truly understand your company’s finances and can communicate them confidently to stakeholders. It means you meet your statutory duties without drama – no rushed filings, no audit panics, no frantic last-minute “fixes.” Instead, you present accounts that stand up to scrutiny, on time and with a clear narrative. This instills confidence at all levels, from the boardroom to the investor community, that the business is in good hands. In contrast, poor preparation erodes that confidence and can lead to real damage – whether it’s fines, reputational hits, or strained relationships with auditors, investors, and banks. In an era of increasing transparency and governance expectations, the cost of getting it wrong is just too high.

The good news is, you don’t have to shoulder this burden alone. Building a strong financial reporting process takes experience and expertise – exactly what our team brings to the table. Our firm’s financial reporting service is delivered by ACA-qualified accountants who trained at Big Four firms, meaning we’ve seen the best (and worst) of reporting practices across industries. We’ve been the auditors combing through year-end accounts, and we’ve been the controllers preparing them – this dual perspective means we know how to pre-empt issues before they become problems. We can help implement and carry out a robust financial statement preparation process tailored to your business. This includes setting up the right controls and checklists, assisting in drafting your financial statements (FRS 102 or IFRS, whatever you report under), and even handling those tricky technical accounting areas that might be new or complex for your team. If you’re gearing up for a year-end audit, we can work alongside you as audit readiness partners – making sure your documentation and numbers are in order, and liaising with your auditors (speaking their language, which we’re fluent in) to smooth out the process. Our goal is to take the pain out of this process for you, turning it into an exercise in confidence-building rather than a source of stress.

Interested in fortifying your financial reporting process? Let’s talk. We offer a free discovery call to assess your needs and discuss how we can help – whether it’s simply getting your next set of statements over the line, or a comprehensive overhaul of your finance controls and governance. We’re passionate about helping CFOs, finance controllers, founders – people like you – sleep easier at night knowing the accounts are under control and stakeholders are happy. Don’t wait until you’re in the thick of year-end pressure or facing a looming deadline. Take action now to set your company up for success. Follow the link to book a discovery call with us, and let’s ensure your financial statement preparation is not just compliant, but a competitive advantage for your business. Here’s to stress-free year-ends and financial statements that you’re proud to put your name on!