The Complete Guide to Balance Sheet Reconciliations

Finance and Accounting exist to establish truth. If the numbers aren’t right, the business isn’t either.

This saying holds especially true when it comes to balance sheet reconciliations. A balance sheet reconciliation is essentially a thorough check to ensure that every number on your balance sheet is backed by reality.

It means verifying that the balances in your general ledger match the corresponding supporting documents for each account. This process is a vital internal control – without regular reconciliations, business owners and executives often lack confidence in their financial statements. For that reason, incorporating balance sheet reconciliations into your monthly or quarterly reporting cycle is critical to producing trustworthy financial reports.

What is a Balance Sheet Reconciliation?

A balance sheet reconciliation is the accounting process of reviewing each balance sheet account to confirm its accuracy before finalizing financial reports. In practice, this involves comparing the recorded balance of each asset, liability, and equity account in your books to an independent source or sub-ledger to ensure they match. For example, cash account balances are compared to bank statements; accounts receivable balances are matched to customer invoices or an aging report; accounts payable is checked against supplier records; and so on. If the general ledger balance for an account doesn’t align with the supporting documentation, the difference is flagged as a reconciling item and investigated.

Reconciling items can arise from harmless timing differences or from errors that need correction. For instance, a check recorded in your books might not have cleared the bank by month-end – a timing difference that will resolve in the next period. Other discrepancies may indicate mistakes, such as a duplicated journal entry or a transaction recorded for the wrong amount. The reconciliation process involves identifying each discrepancy, determining its cause, and adjusting the records if necessary. The ultimate goal is that after all adjustments, every balance sheet account’s ledger balance matches its supporting documents, giving assurance that the balance sheet is accurate and complete. A fully reconciled balance sheet also obeys the fundamental accounting equation (Assets = Liabilities + Equity) with no unexplained variances.

Why Balance Sheet Reconciliations Are Important

Balance sheet reconciliations may sound like tedious bookkeeping, but they deliver critical benefits that ripple through your entire business. Here are some of the key reasons why regular reconciliations are well worth the effort:

-

Accurate Financial Statements: Reconciliations ensure that the figures reported on your balance sheet (and by extension, your income statement and cash flow) are correct and up-to-date. By catching and correcting errors or omissions, you prevent incorrect data from making its way into your financial statements. This accuracy is foundational – decisions made on faulty financials can be devastating, so it’s paramount to get the numbers right.

-

Catch Errors Early: Regular reconciliations help spot discrepancies and errors early – before they snowball into bigger problems. A transposed digit, a missed journal entry, or a misclassified transaction can be identified and fixed during the reconciliation process. Finding these issues in, say, January is far easier than discovering them a year later during an audit. In short, reconciliations are an ongoing quality control that keeps your books clean.

-

Fraud Detection and Prevention: Reconciliation is also an important mechanism for detecting potential fraud or unauthorized transactions. By comparing every transaction and balance to an external source, you create a chance to notice anomalies (like mysterious withdrawals or entries that shouldn’t be there) and investigate them. This regular scrutiny can uncover signs of fraud and act as a deterrent for would-be misappropriation. Many financial frauds have been prolonged or undetected in companies that neglected to reconcile accounts — for example, Steinhoff International, which suffered a multibillion-euro accounting scandal largely due to weak internal controls and undisclosed adjustments over several years.

-

Regulatory Compliance: Maintaining reconciled accounts helps ensure you are in compliance with accounting standards and regulations. In fact, generally accepted accounting principles (GAAP) and IFRS effectively require that financial statements be free of material errors, which regular reconciliations support. Consistent reconciliations help you meet reporting requirements, avoid regulatory fines, and steer clear of legal issues that can arise from inaccurate reporting.

-

Internal Control Strength: A balance sheet reconciliation process is often cited as one of the most important internal controls. It provides a checkpoint to verify that internal recording processes are working properly. When accounts don’t reconcile, it flags a weakness in your accounting process or controls that management should address. Thus, doing reconciliations not only finds errors but also helps identify process improvements to prevent future issues. It’s a proactive way to strengthen the financial control environment.

-

Better Decision-Making: High-quality reconciled financial data leads to better business decisions. When management knows the balance sheet is reliable, they can plan and make strategic choices with confidence, using insights from accurate data. Conversely, if the books are unreliable, leaders may hesitate or, worse, base decisions on incorrect information. Companies that keep their financials tidy (through processes like reconciliation) tend to make more informed decisions and avoid costly missteps.

-

Stakeholder Confidence: Accurate financials build trust not just inside the company, but outside as well. Investors, board members, lenders, and even employees take comfort in financial statements that have no nasty surprises lurking. Performing regular balance sheet recs signals stability and professionalism to these stakeholders. When your financial statements are clearly accurate and consistent, it inspires confidence among investors and partners, who see that management has a firm grasp on the numbers. This can be key when seeking financing or trying to impress a potential investor or buyer.

-

Smoother Audits & Reporting: If you’ve ever been through a financial audit, you know how much easier life is when all accounts are reconciled. Auditors consider reconciliations a basic indicator of financial hygiene. When your accounts tie out perfectly, audits go much quicker and with fewer adjustments, saving everyone time and possibly reducing audit costs. Timely reconciliations also mean you won’t be scrambling to explain discrepancies to auditors or regulators. In short, you’ll be audit-ready at any moment, with well-organized documentation to back up your figures.

Fitting Reconciliations into Your Reporting Cycle

How often should you reconcile your balance sheet accounts? The short answer: regularly. It’s good practice to reconcile at the end of each accounting period – typically every month for most businesses, or at least every quarter. Regular intervals ensure that errors or issues are caught and corrected in a timely manner.

Many companies aim to reconcile key accounts monthly and then include a full reconciliation of all accounts as part of their quarter-end or year-end close. For example, you might do all high-activity accounts (cash, accounts receivable, accounts payable, payroll, etc.) each month, and perhaps reconcile some low-activity accounts quarterly. One recent industry guide noted that companies often start by reconciling around 70% of their balance sheet accounts monthly (focusing on core areas), but ultimately move toward reconciling 100% of accounts for a truly clean close. The more accounts you reconcile regularly, the more confidence you can have that your balance sheet is fully accurate.

It’s worth noting that frequency might vary by account risk. Bank accounts, for instance, might be reconciled even daily or weekly by a treasury team because cash is so critical. Inventory or credit card accounts could be done monthly, whereas a minor equity account might be checked quarterly if activity is minimal. However, the best practice is to reconcile all accounts at least monthly whenever feasible. Issues are much easier to resolve when only a few weeks old rather than several months old. As one expert aptly put it, finding and fixing a discrepancy now (when the transaction details are fresh in mind) might take 15 minutes, whereas waiting a year could turn the same issue into a multi-hour investigation. Regular monthly reconciliations spread out the workload and prevent nasty surprises at quarter-end.

In modern finance, some companies are even adopting continuous reconciliation – using software that updates and compares balances in real time throughout the month. Whether your business needs continuous monitoring or just a solid month-end routine, the key is to schedule reconciliations as a non-negotiable part of your close process. Make it a habit, and soon it will feel like a natural step each period, rather than a fire drill after year-end.

How to Perform a Balance Sheet Reconciliation (Step-by-Step)

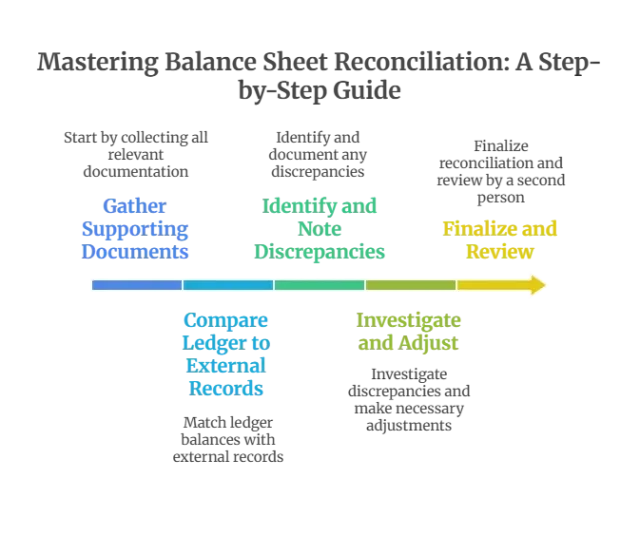

Performing a balance sheet reconciliation involves a series of repeatable steps. Below is a step-by-step guide outlining a typical reconciliation process:

-

Gather Supporting Documents: Start by collecting all relevant documentation for the accounts you’re reconciling. This includes things like bank statements, credit card statements, accounts receivable aging reports, accounts payable listings, loan statements, payroll records, and any other source documents that show the “true” balance of an account. You’ll also need the general ledger (trial balance) figures for each account. Having all these records on hand is the prerequisite for a smooth reconciliation.

-

Compare Ledger to External Records: For each account, compare the balance per the general ledger to the balance per the supporting document(s). This could mean matching the ending balance on the bank statement to the cash account in the GL, or comparing the total of all customer unpaid invoices to the accounts receivable balance on the GL. Ideally, these should match. Note any differences between the GL and the external sources – these are your initial reconciling items.

-

Identify and Note Discrepancies: As you compare, identify each discrepancy and determine its nature. Common reconciling items include timing differences (e.g. a deposit recorded on books on March 31 that doesn’t appear on the bank statement until April 1) and errors (e.g. a transaction recorded incorrectly or a missed entry). Make a list or mark up the reconciliation with every unmatched item or difference you find, so you can address them one by one. It’s normal to have a few reconciling items; the goal is to ensure they are explained and will clear, or else corrected.

-

Investigate and Adjust: Investigate the cause of each discrepancy and take appropriate action. If it’s a legitimate timing difference, you simply document it and ensure it will resolve next period. If it’s an error or omission, you’ll need to correct it by recording an adjusting journal entry in the general ledger. For example, if a $500 invoice was omitted from the books, you’d add it; if $100 was mistakenly double-counted, you’d remove the duplicate. This step may involve going back to source documents, talking to staff or even external parties (like a bank or vendor) to get to the bottom of an issue. Once identified, post the necessary adjustments so that the GL balance will properly reflect reality.

-

Finalize and Review: After adjustments, double-check that the account is now fully reconciled – the ledger and supporting documents agree to the penny. Also verify that your total Assets = Liabilities + Equity after all adjustments (a balanced balance sheet). Then, document the reconciliation. This often means saving a reconciliation worksheet or report, along with copies of the supporting docs, and writing a brief explanation for any notable items. It’s also a best practice to have a second person review and sign off on each reconciliation – for example, a supervisor or controller reviews the preparer’s work. This review provides accountability and catches any mistakes in the reconciliation process itself. Once reviewed, file the reconciliation documentation in an organized manner (electronically or paper) so it’s available for auditors or future reference.

Following these steps each period will ensure a consistent and thorough reconciliation process. Over time, this routine becomes more efficient as your team knows exactly what to check and how to resolve issues.

Common Risks and Pitfalls of Not Reconciling

Neglecting balance sheet reconciliations – or performing them haphazardly – can lead to serious problems. Here are some of the key risks and pitfalls that companies face when they don’t reconcile regularly and properly:

-

Accumulating Suspense or Unknown Balances: Without regular reconciliation, you may start to see mysterious balances build up in your accounts – often parked in a suspense account or simply left unexplained. These accounts can become dumping grounds for unresolved mismatches, effectively acting like “black holes” in your financials. What might start as a small unexplained amount (say a £100 difference) could actually be masking a larger issue or error beneath the surface. Over time, suspense balances that linger can grow and make your balance sheet less and less reliable (and harder to clean up later).

-

Errors and Misstatements: When accounts aren’t reconciled, errors in the books can go undetected for long periods. Small mistakes compound over time – a missed accrual here, an overstatement there – and the result can be significantly misstated financial statements. In extreme cases, companies have discovered multi-million dollar discrepancies that accumulated over multiple periods due to lack of reconciliation. For example, one well-known retailer had a £100+ million accounting error that built up over more than a year, sparking restatements and management scrutiny. The longer errors go unchecked, the more damaging they become, potentially misleading management and investors about the company’s true financial position.

-

Audit and Compliance Issues: Companies that don’t reconcile regularly often face harsh feedback during audits. External auditors will flag unreconciled accounts as a material weakness or control failure. At best, this leads to a lot of extra audit work (and audit fees) to figure out the differences; at worst, it can result in a qualified audit opinion or required restatement. Macy’s faced significant scrutiny after a lack of proper balance sheet reconciliations led to a $150 million build-up in merchandise accruals, which had to be corrected in its 2020 financials. The incident highlighted the critical importance of robust reconciliation processes in preventing material misstatements and maintaining investor trust.

-

Loss of Trust and Integrity: Perhaps the biggest intangible risk is the loss of confidence from stakeholders. A balance sheet full of unexplained variances and accounts that don’t tie out will quickly undermine the credibility of the finance team. Both the executive board and external parties (investors, lenders) rely on the CFO’s numbers to be solid. If finance leadership can’t fully explain every line on the balance sheet, it erodes trust in the financial reporting. This can have far-reaching implications – investors might doubt the company’s performance reports, banks might hesitate to extend credit, and the board may lose faith in management’s financial stewardship.

-

Higher Fraud Risk: Gaps or laxity in the reconciliation process can create opportunities for fraud. When accounts aren’t reconciled, it’s easier for someone to hide a theft or manipulate results, because the “holes” in the records aren’t being actively looked at. In contrast, regular reconciliations increase the likelihood that irregularities will be spotted and questioned. Many internal fraud schemes exploit neglected areas of the books. Implementing diligent reconciliations helps close that door – it’s no coincidence that companies with strong account reconciliation practices tend to have lower incidence of fraud. In sum, failing to reconcile is like leaving your financial backdoor unlocked.

The difference between maintaining solid reconciliation practices and neglecting them is stark. The table below highlights a few of the outcomes with and without regular balance sheet reconciliations:

| Aspect | Regularly Reconciled | Not Regularly Reconciled |

|---|---|---|

| Financial Accuracy | High – Financial statements are accurate and reliable; any errors are corrected promptly each period. | Low – Errors accumulate over time, leading to potential misstatements in financial reports. |

| Stakeholder Confidence | Strong – Board, investors, and lenders have confidence in the reported numbers and management’s oversight. | Undermined – Stakeholders become skeptical of the reports; management may lose credibility with the board. |

| Fraud Risk | Reduced – Anomalies are quickly spotted and addressed, deterring fraud or misuse of assets. | Elevated – Irregularities or dishonest activities can go unnoticed longer, increasing the chance of undetected fraud. |

| Decision Making | Informed – Management can make decisions knowing the data is trustworthy and up-to-date. | Impaired – Decisions might be based on incorrect data, or leadership hesitates due to lack of trust in the numbers. |

| Audit & Compliance | Smoother – Audits and regulatory reporting go faster with fewer issues; company meets compliance requirements. | Difficult – Auditors find more issues (leading to higher fees and delays); risk of non-compliance with accounting standards or regulations. |

The CFO and Management Perspective

From a CFO’s perspective, balance sheet reconciliations are more than an accounting formality – they’re a safeguard for the company’s credibility. The finance chief (and controller) needs to be able to walk into a board meeting, investor presentation, or audit committee review and stand behind the numbers with confidence. That confidence is hard to come by if, say, there are significant unexplained balances or known errors on the books. On the other hand, when every account is reconciled and buttoned-up, the CFO can speak to the financials with authority, knowing there are no hidden skeletons. It provides peace of mind that there won’t be unwelcome surprises cropping up later.

Regular reconciliations also support the management team’s fiduciary responsibility. Board members and CEOs are increasingly aware of the importance of strong financial controls. Seeing that the finance team produces fully reconciled balance sheets each period gives leadership assurance that the company’s financial health is being monitored and preserved. As one nonprofit finance guide noted, the final reconciliation review before closing the books is an opportunity to build confidence in board members and auditors by ensuring all records are accurate. The same holds true in the for-profit world – executives and directors take comfort in knowing the numbers have been thoroughly vetted.

Strong audit committee practices and transparent financial reporting—like timely balance sheet reconciliations—can significantly enhance investor confidence, as highlighted by the FRC’s guidance on good audit committee reporting.

Moreover, reliable reconciliations can directly impact strategic outcomes. For example, if a company is seeking a loan or investment, having a reputation for clean financials (with no unresolved discrepancies) can make due diligence go much smoother. Investors and banks often ask management pointed questions about financial anomalies; a CFO who can definitively answer “everything is reconciled and any differences are explained” will instill far more trust. In contrast, being unable to explain weird balance sheet entries is a fast way to lose credibility with stakeholders. In essence, solid reconciliation practices are a reflection of good governance and oversight, which upper management and boards absolutely care about.

Streamlining the Reconciliation Process

It’s clear that balance sheet reconciliations are important – but they can also be time-consuming. The good news is that modern accounting teams have tools and methods to streamline the process and make reconciliations more efficient. Here are a few ways to improve your reconciliation process:

-

Leverage Technology: A number of software solutions exist specifically to automate account reconciliations and financial close tasks. These tools can pull data from your ERP and bank systems, match transactions automatically, and even alert you to discrepancies. Automation dramatically reduces the manual drudgery of ticking and tying numbers. By using dedicated reconciliation software, companies can reduce errors and free up time for their finance staff. In fact, automation can handle a lot of the heavy lifting (like matching routine transactions), allowing your team to focus on investigating the truly unusual items. Many mid-to-large organizations use platforms like this to speed up month-end close while increasing accuracy.

-

Standardize and Document: Having a standard reconciliation template or checklist for every account helps ensure nothing falls through the cracks. It also makes it easier to onboard new team members to the process. For example, you might create a reconciliation workbook for each account that includes sections for beginning balance, ending balance per GL, ending balance per external source, reconciling items with explanations, and sign-off. A standardized approach enforces consistency. It’s also wise to document your findings – note the reasons for differences and how they were resolved. Good documentation will prove invaluable during audits or if someone new reviews the work.

-

Risk-Focus and Frequency: Not all accounts carry the same risk. Consider categorizing accounts by risk or size and reconciling accordingly. High-risk or large accounts (like cash, inventory, or any account prone to errors) should be reconciled more frequently (monthly or even weekly) and with extra scrutiny. Lower-risk, low-activity accounts might be fine with quarterly reconciliation – but never let them go un-reconciled indefinitely. Applying risk ratings to accounts can help your team focus effort where it matters most. This way, you ensure that critical accounts are always airtight, and you allocate resources efficiently.

-

Train and Rotate Staff: Ensure your accounting team is well-trained on how to do reconciliations effectively. Sometimes errors persist because staff aren’t sure how to investigate them or perhaps don’t realize the importance. Training can cover techniques for tracing discrepancies and using any reconciliation tools you have in place. It’s also a good idea to implement a review or rotation system – for instance, have a second person review reconciliations, or rotate who prepares certain account recs. A fresh pair of eyes might catch issues that the preparer overlooked.

-

Seek Expert Help if Needed: If your team is stretched thin or lacks certain expertise (for example, complex reconciliation of intercompany accounts or technical accounting issues), consider bringing in outside help. This could mean hiring an external accountant/consultant for the close period or using an outsourced accounting service to perform some reconciliations. An external expert can help implement best practices, get your reconciliations up to standard, and even handle the process for you on a periodic basis. The investment in professional help can pay off by preventing errors and establishing a strong reconciliation discipline for the future.

By streamlining via the above methods, balance sheet reconciliations become far less burdensome. Many companies find that after improving their process (through better tools, training, or outside assistance), the reconciliations go from a stressful end-of-quarter scramble to a relatively routine task each month. The end result is a faster close with confidence in the numbers – exactly what any CFO or business owner wants.

Conclusion

Balance sheet reconciliations might not be the most glamorous part of finance, but they are undeniably a cornerstone of sound financial management. When done consistently, they provide assurance that your financial statements are accurate, your internal controls are effective, and your business is on solid footing. A reconciled balance sheet means no surprises: every figure is backed by evidence, which in turn means management and stakeholders can rely on the reported information to make decisions. In an environment where trust and transparency are paramount, this process transforms risk into confidence.

If your organization has been neglecting balance sheet reconciliations or struggling to do them properly, now is the time to act. The longer you wait, the harder it becomes to untangle issues – and the greater the risk to your company’s financial integrity. On the flip side, by investing the effort (or engaging expertise) to implement a robust reconciliation process, you’ll reap benefits in accuracy, efficiency, and credibility that far outweigh the costs. It sets a tone of diligence and accountability that will permeate your finance operations.

Remember, when it comes to your company’s financial truth, there’s no room for doubt. Regular balance sheet reconciliations are one of the best ways to eliminate doubt and instil confidence in your numbers.

Next Steps: If you want to strengthen your balance sheet reconciliation process or need help catching up, consider reaching out for professional assistance. At LedgerRoot, we specialize in helping companies implement effective reconciliation routines and controls. We can even perform or support your reconciliations as part of your monthly/quarterly close, ensuring nothing is overlooked. Feel free to book a free discovery call with our team to discuss your needs and see how we can help bolster your financial reporting. With the right processes in place, you can close each period knowing your balance sheet (and your business) are truly balanced and reliable.