Why Your Balance Sheet May Be Holding You Back — And How Monthly Reconciliations Solve It For Good

If reconciling your balance sheet feels like wrestling with a beast every quarter, you’re not alone. Missed entries, stale suspense accounts, and dusty accruals can turn clean books into financial guesswork. But what if keeping clean, audit-ready financials was as easy as scheduling a regular service—just like outsourcing payroll or IT?

Here’s why monthly (or quarterly) balance sheet reconciliations are a game-changer—and how Ledger Root’s services offer a strategic, revenue-generating solution for growing companies.

1. The True Cost of Letting Accounts Linger

We all know how balance sheet errors creep in:

- Suspense and unknown balances persist when entries sit unresolved in clearing accounts.

- Manual misstatements (like typos or duplicates) accumulate unnoticed.

- Fraud risk creeps in when subsystems aren’t reconciled regularly.

Failing to reconcile regularly means:

- Financial distortions: GAAP/IFRS compliance requires clean books—and auditors will flag material omissions.

- CFO stress: Inaccuracies erode stakeholder confidence and slow decision-making.

- Audit nightmares: Unresolved discrepancies lead to expensive audit adjustments or qualified opinions.

Our detailed Complete Guide to Balance Sheet Reconciliations covers all the fundamentals to a strong balance sheet reconciliations, including risks associated with leaving accounts unreconciled.

In March 2025, Ernst & Young issued an adverse opinion on UBS’s internal controls—specifically flagging serious deficiencies in how it managed the legacy balance sheet and financial reporting systems inherited from Credit Suisse and in the case of NMC Health, EY was accused by UK administrators of ‘extremely serious’ audit failures—most notably ignoring key general‑ledger evidence that concealed billions in liabilities. While these examples are both different, they confirm the importance of understanding what is on your balance sheet.

2. Why Monthly (or Quarterly) Reconciliation Matters

Here’s why periodic reconciliation transforms finances:

- Prevent small discrepancies from exploding. Catch mistakes before they snowball.

- Strengthen internal controls. Regular reconciliations show strong segregation of duties.

- Boost financial trust. Consistent balance integrity builds confidence with lenders, auditors, and investors.

- Enable strategic planning. CFO-level decisions rely on clean data—accurate forecasts, debt covenants, and fundraising readiness.

3. Manual vs Automated Reconciliation: Pros & Cons

Let’s compare approaches:

| Approach | Pros | Cons |

|---|---|---|

| Manual (Excel) | Flexible, low tech setup | Time-consuming; human error; poor documentation & audit trails |

| Basic rule-based | Faster, some automation of common matches | Still manual follow-up; limited exception handling |

| Automated tools | Rule-based matching, central audit trails, dashboards | Requires setup and integration; cost investment |

| AI / Agentic tools | Smart matching, anomaly alerts, independent decisioning | Cutting-edge; may be overkill for many SMBs |

4. Why Recurring Reconciliation = Recurring Revenue

A. Clean-Up Engagement (One-Time Sprint)

We’ve all confronted messy balance sheets. Organized like this:

- Suspense accounts with no explanation

- Unsupported accruals and credit memos

- Duplicates or stale manual journals

Our solution: two-week clean-up sprint. We dive in, reconcile messy accounts, document everything, and surface internal control issues. We provide:

- Detailed list of adjustments

- Clean GL & closing docs

- Control diagnostics

B. Recurring Reconciliation as a Service (RaaS)

We bill monthly or quarterly, offering:

- Monthly reconciliation of high-risk accounts (cash, AR, AP, accruals)

- Quarterly or semi-annual reconciliation for low-activity accounts

- Custom templates, full documentation, sign-off workflows

- Dedicated Slack/Teams channel for exceptions

- Audit-ready reporting package

For clients, this is:

- Bookable in advance (budget-friendly monthly fee)

- Straightforward renewals

- High retention, low churn – because once monthly workflows are running, clients depend on it

5. How We Build Stronger Internal Controls

We don’t just reconcile—we empower finance teams. That means:

- Defining clear RACI matrices for reconciliations

- Documenting controls: timelines, reviewer sign-offs, retention policies

- Training teams on correct investigation and documentation

- Flagging root-cause process issues and recommending solutions

6. Who Benefits Most From Our Services

- VC-backed scaleups preparing for Series B/C, EBITDA, or audit

- Tech startups looking to streamline month-end close

- Mid-market companies with part-time finance teams

- Organisations with high-volume ops (multiple bank accounts, payroll, intercompany)

7. What It’s Like to Work with Ledger Root

- Discovery call (30 min): understand scope, volume, and SLAs

- Data onboarding: GL exports, bank statements, subledgers

- Clean-Up Sprint (2 weeks): weekly touchpoints; final summary report

- Set-up recurring: templates, workflows, approval channels

- Monthly / quarterly cycle: delivery, documentation, debrief

- Monthly KPI insights: open items, cycle times, control gaps

8. Results You Can Expect

Clients often report:

- 50–80% reduction in close-time vs manual-only processes

- Reduced audit adjustments – clean books = faster, cheaper audits

- Improved visibility on stale items – no suspense account creep

- Better allocation of finance resources to strategic analytics

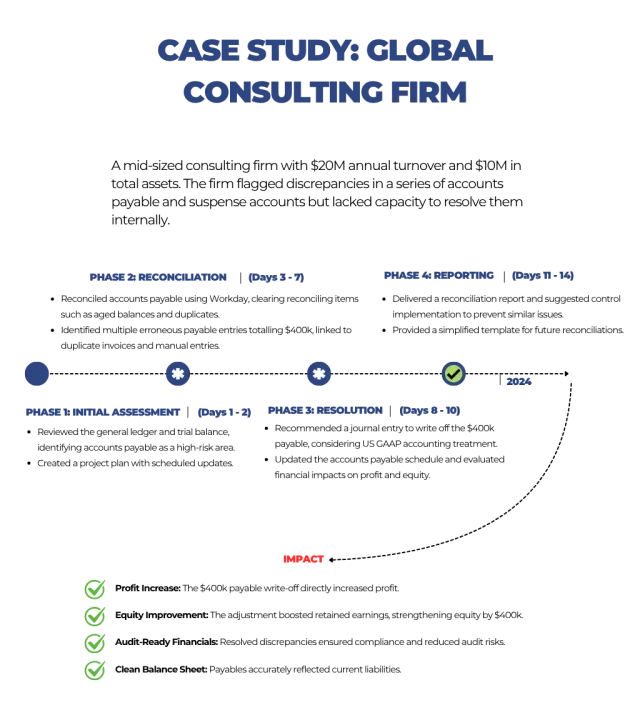

9. Real-World Results: Case Study from a $20M Global Consulting Firm

To show the real-world impact of timely balance sheet reconciliations, here’s a case example of how we can help:

A mid-sized consulting firm with $20M annual turnover and $10M in total assets was struggling to resolve persistent discrepancies in their accounts payable ledger and suspense accounts. Internal resources were stretched thin, and year-end close was looming.

Our 14-Day Intervention Delivered Tangible Results

Phase 1: Initial Assessment (Days 1–2)

We began by reviewing their general ledger and trial balance, identifying accounts payable as a high-risk area. A reconciliation project plan was created with daily check-ins and clear responsibilities.

Phase 2: Reconciliation (Days 3–7)

We performed a detailed reconciliation using Workday, investigating and clearing reconciling items including aged balances and duplicates. Our team identified multiple erroneous payable entries totaling $400k, mostly due to duplicate invoices and manual postings.

Phase 3: Resolution (Days 8–10)

We recommended and booked a US GAAP-compliant journal entry to write off the $400k payable, after confirming the balances were overstated. Adjustments were made to the AP schedule, and financial implications were modeled.

Phase 4: Reporting (Days 11–14)

We delivered a full reconciliation report, a simplified monthly template, and internal control recommendations to ensure the issue didn’t recur. This enabled the client to integrate monthly reconciliation into their close process.

Impact Highlights

| Impact Area | Result |

| Profit Increase | $400k payable write-off increased reported profit |

| Equity Improvement | Boosted retained earnings, strengthening the balance sheet |

| Audit-Ready Financials | Clean accounts enabled faster, smoother external audit |

| Clean Balance Sheet | Accounts payable accurately reflected current liabilities |

10. Bottom Line: Turn Process into Product

Balance sheet reconciliation is more than accounting – it’s a stabilizer for financial operations. By packaging it as a clean-up sprint + recurring service + control framework, you’re:

- Solving a deep pain for finance teams

- Creating a predictable, monthly recurring revenue source

- Building long-term client relationships through ongoing operations

Next Step: Start Clean, Stay Clean

Ready to ditch the reconciliation stress? Our free Discovery Call lets us assess your GL environment, flag risks, and show how Ledger Root can both clean up and automate your close process.

Book your 30-minute discovery call and get your balance sheet under control—all year round.